Accounting Journal Entries

View custom daily or end-of-month journal entries. The report is compiled based on your saved GL codes and report preferences, which can be set using the parameters page. If report preferences and GL codes are not set up then the report will use default settings.

You can upload the report data to Quickbooks Desktop. Click here for instructions.

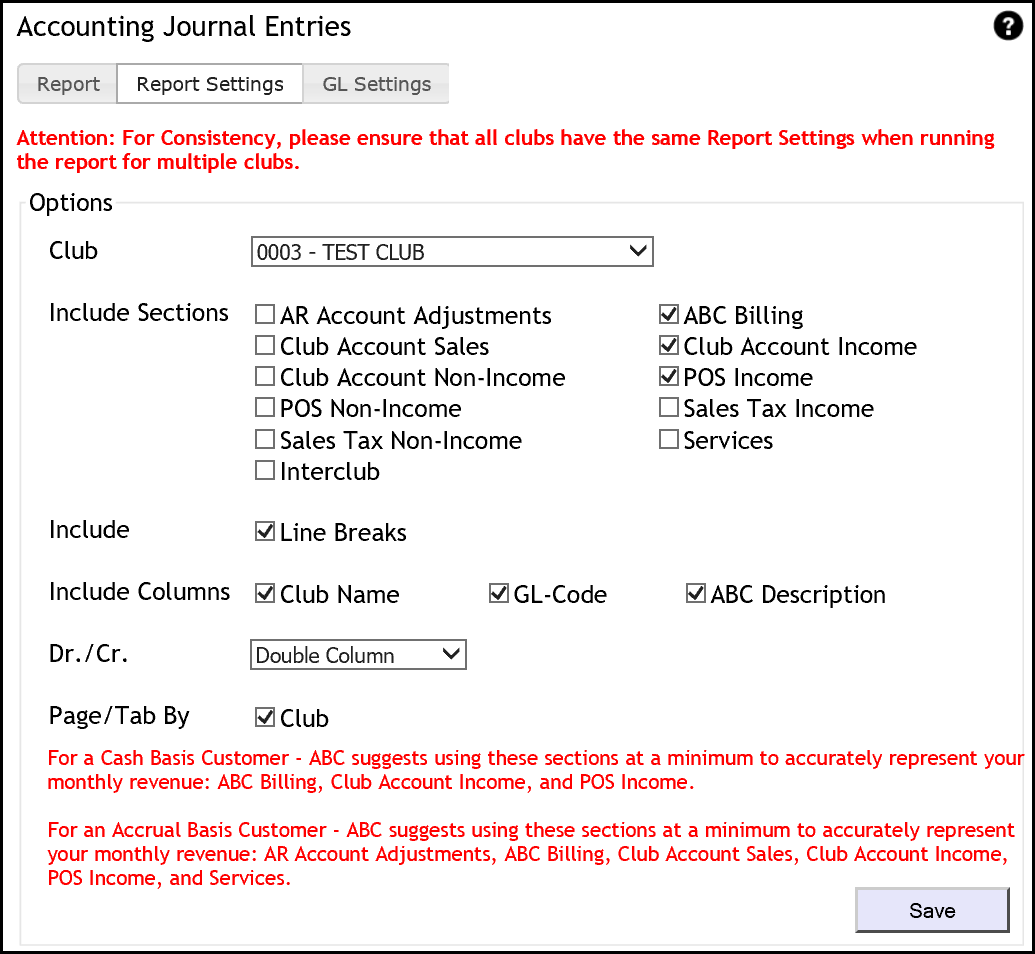

If multiple clubs are selected for which different report preferences are applied, then the report will use the report preferences attached to the lowest numbered club in the list. Please ensure that the same report settings are applied to all the clubs in your list. Settings must be applied to each club from the parameters page using the Reporting Settings and GL Settings tabs.

Each section of the report balances independently. For example, Sales Tax Income section debits should equal credits within that section. This design allows you to avoid entries for non-income and interclub activity, as needed.

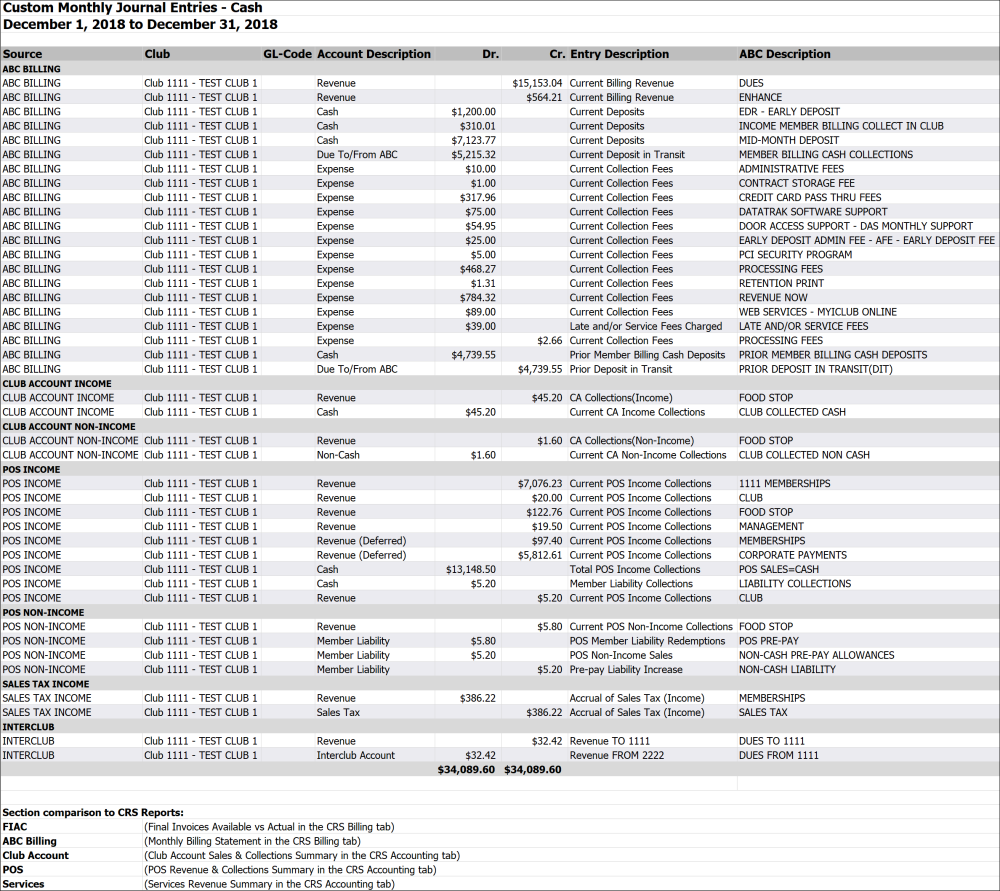

The report includes a list of summary reports you can cross reference: Final Invoices Available vs. Actual, Monthly Billing Statement, Club Account Sales & Collections Summary, POS Revenue & Collections Summary, and Services Revenue Summary. In browser format, these report titles are formatted as hyperlinks leading to each report. When the report is generated in Excel format for a single club, these reports are included as additional tabs in the workbook. Please note that the interclub and sales tax sections can be cross referenced with the Daily Revenue & Deposit Reconciliation report, also located under the Accounting tab.

When the report is generated in CSV format, all club journal entries are displayed on one tab.

A sample report is displayed below.

Report Settings

You can customize your report settings for the selected club or you can use the default settings to generate the report. Default settings include line breaks, all available columns, and double columns for debit and credit entries. We recommend the following sections, based on whether your clubs uses cash basis accounting or accrual basis accounting.

- For cash basis customers ABC recommends ABC Billing, Club Account Income, and POS Income.

- For accrual basis customers ABC recommends AR Account Adjustments, ABC Billing, Club Account Sales, Club Account Income, POS Income, and Services.

After you select report settings, click Save. The report will now use these settings in future sessions to set parameters for your results.

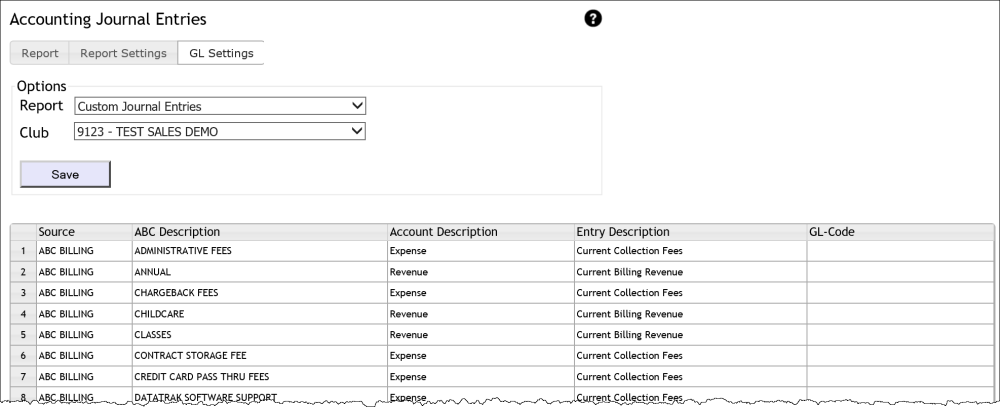

GL Settings

You can add GL codes for the selected club by clicking the GL Settings tab from the parameters page. Click the GL Code field and type in your code then click Save to capture your changes.