POS Revenue and Collections Summary

This report provides information for use in accrual accounting.

Report Summary

This report provides data on point of sale (POS) collections and revenue. You can view the data as journal entries or a summary. The Journal Entries report can help complete account ledgers for businesses using accrual accounting.

This report uses DataTrak information. If you do not use DataTrak then no information will be available to produce this report.

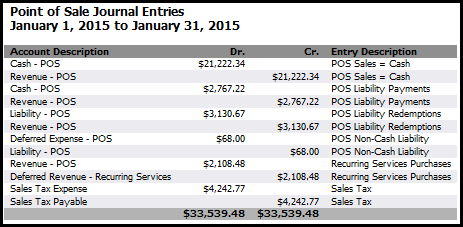

Journal Entries

This report format translates vital information found in the summary report into journal entries, which can be used to help complete account ledgers.

You can generate the Journal Entries report in Browser, Excel, PDF, or Comma Delimited format for one or multiple clubs.

Sample Journal Entries Report

Here is a sample of the Point of Sale Journal Entries report:

Summary Report

The summary report provides an overview of POS collections and revenue, with the option of viewing member-level detail by selecting any figure formatted as a blue hyperlink.

The summary report includes the following sections:

- POS Collections by Payment Type

- POS Revenue by Profit Center

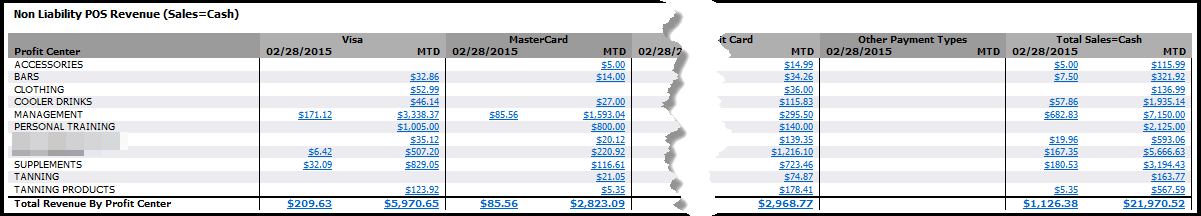

- Non Liability POS Revenue (Sales=Cash)

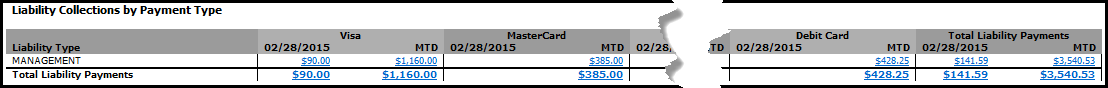

- Liability Collections by Payment Type

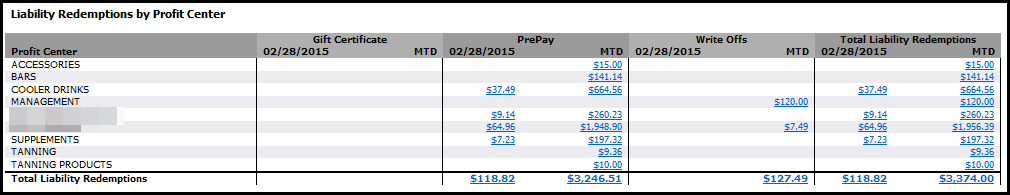

- Liability Redemptions by Profit Center

- Deferred Expense/ Non Cash Liability Entries

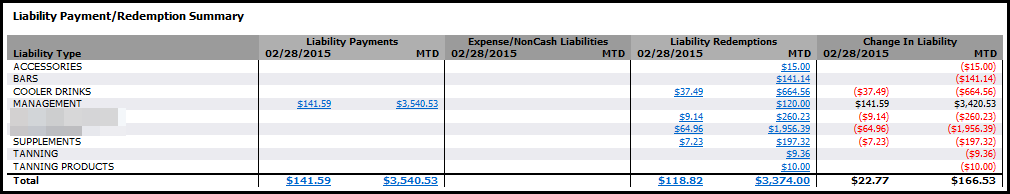

- Liability Payment/Redemption Summary

- POS Revenue Summary

The Summary report is available in Browser or Excel format. You can generate the report for one or multiple clubs.

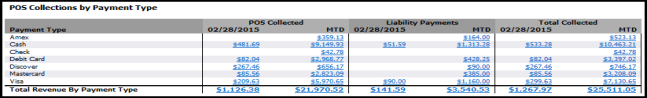

POS Collections by Payment Type

The POS Collections by Payment Type section displays cash payments collected by the club in POS transactions. This section does not include Club Account collections.

Liability payments are POS cash payments collected by the club for future goods and services. Liability payments include gift cards and pre-paid services.

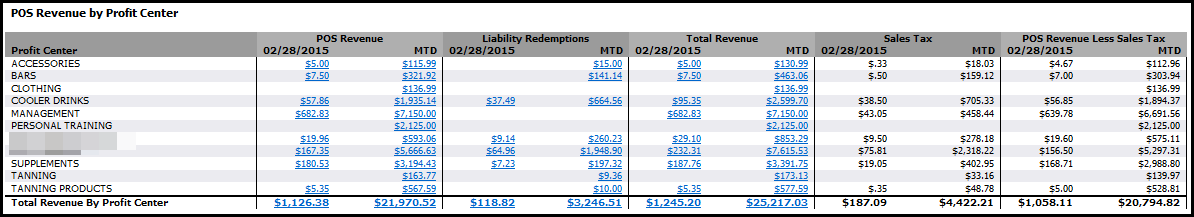

POS Revenue by Profit Center

The POS Revenue by Profit Center section displays all POS revenue by profit center. The figures include sales tax. Club Account sales are not included in this section.

Non Liability POS Revenue (Sales=Cash)

The Non Liability POS Revenue (Sales=Cash) section can be used to assist in reconciling sales with collections.

The Total Sales segment does not include liability payments or redemptions.

Liability Collections by Payment Type

The Liability Collections by Payment Type section shows liability items and the form of payment used to purchase them.

Liability Redemptions by Profit Center

The Liability Redemptions by Profit Center section shows liability types such as gift certificates and the profit centers toward which they were redeemed.

Deferred Expense/Non Cash Liability Entries

The Deferred Expense/Non Cash Liability Entries section shows non-cash liability types and the deferred expense items with which they are associated.

Liability Payment/Redemption Summary

The Liability Payment/Redemption Summary shows a comparison of the number of liability payments versus liability redemptions. Changes in liability for the day and month to date (MTD) are provided.

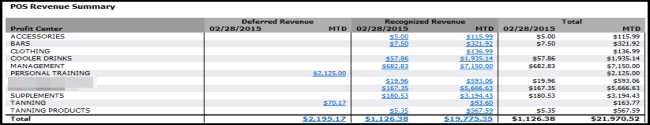

POS Revenue Summary

The POS Revenue Summary distinguishes revenue as deferred revenue or recognized revenue, showing all revenue collected by profit center. You can view total daily and MTD revenue in the last two columns of this section.