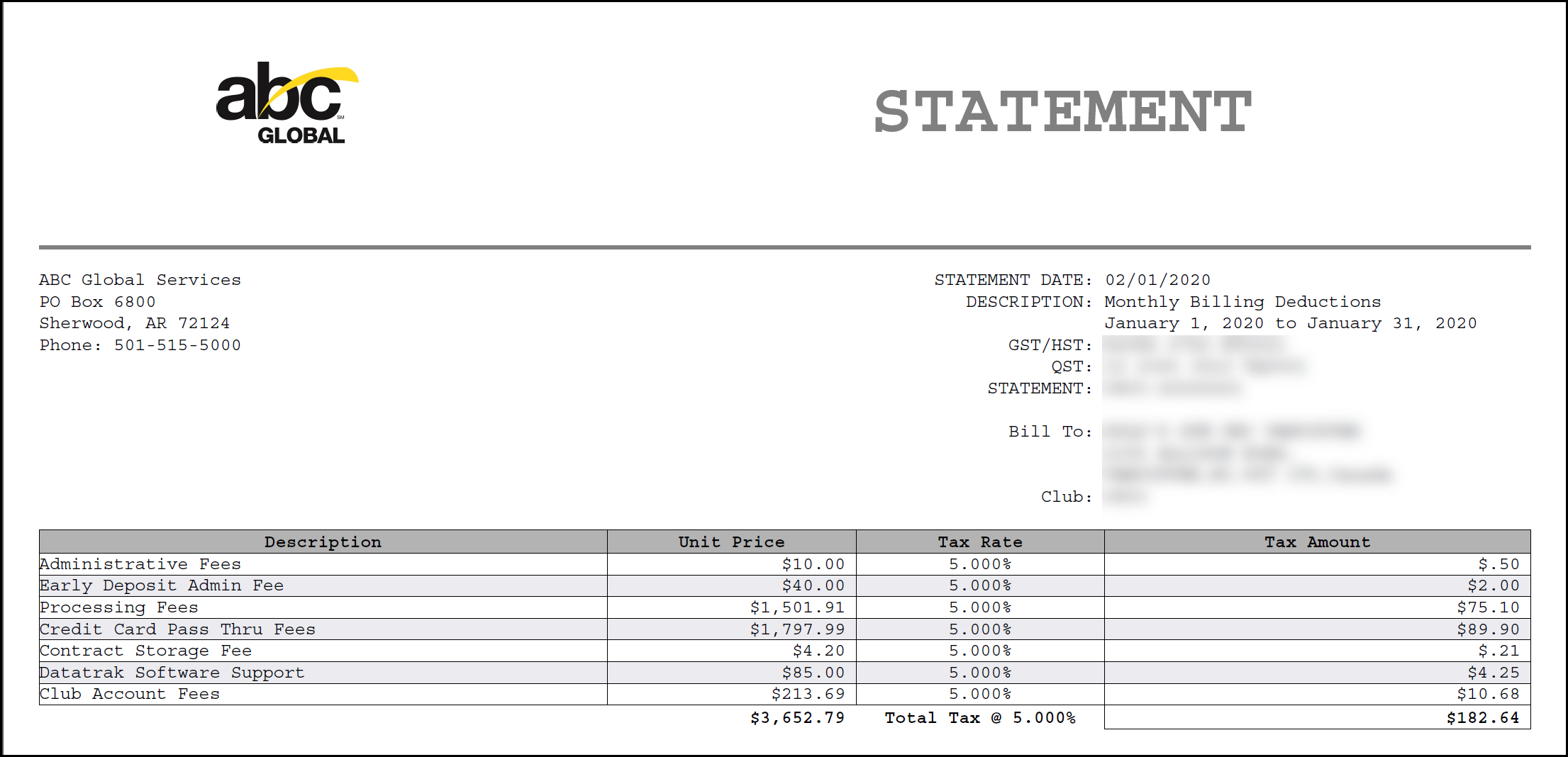

Canadian Tax Statement

Use this report to view taxes incurred for taxable deductions and reimbursements. Taxes are determined at the province level and include:

- Goods and Services Tax (GST)

- Harmonized Sales Tax (HST)

- Quebec Sales Tax (QST), where applicable

GST and HST apply to ABC’s fees, such as transaction processing, DataTrak Software Support, MYiCLUBonline, PCI, and administrative. Taxability has been determined in coordination with our Canadian tax accountants and is subject to change based on future tax law or other regulatory mandates.

This report is limited to Canadian clubs. End-of-month data is displayed in the form of a statement including Club Account and ABC member billing deductions.

The total tax amount is calculated using the total unit price and the average tax rate. This total may vary by pennies from the tax amount found when summing each unit's tax amount. This occurs due to rounding.

This report will show a QST (Quebec) tax, even with clubs that are not in Quebec.

Calculating Taxes

After the ABC Billing System has determined that the deduction is taxable, taxes are calculated using tax rates for the relevant Canadian province. CRS will calculate the tax for the previous month’s billing fees based on the province in which the club resides. The tax amount will then be deducted in the following month.

The following is a step-by-step example of how May billing deductions are taxed, how the tax is deducted in June, and then how the GST/HST is reported on June CRS reports.

- CRS calculates the GST/HST on May’s billing deductions.

- The GST/HST amount is deducted in June.

- The June Canadian Tax Statement shows what the tax deduction will be on the June billing reports.

- The GST/HST deduction itself is shown on the June DRDR, MBS, and DBS reports.

For information about the GST/HST, visit https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/charge-gst/charge-gst-hst.html.

We recommend that you consult with your tax advisor to determine if any changes to your current processes are needed.

Comparison with Other CRS Reports

Please note the following differences between the Canadian Tax Statement and other CRS reports.

Monthly Billing Statement - The report sums amounts using deduction codes. Deduction codes are not displayed in the report, but are used during report compilation to identify and sum like codes. Please note that line items may be categorized differently in the Monthly Billing Statement because the Monthly Billing Statement groups deductions by name instead of code.

Daily Revenue and Deposit Summary - As with the Daily Revenue and Deposit Reconciliation report, CRS will pull deductions and reimbursements to the Canadian Tax Statement. However, unlike the Daily Revenue and Deposit Reconciliation report, the tax statement will only show deductions and reimbursements that are taxable. The tax is based on the province in which the club resides and the appropriate provincial tax rates.

Availability

The Canadian Tax Statement will be available within a few business days after End of Month billing. The report will be available in CRS (Billing tab) or scheduled via automation/email.